by Joe Herrle, CFA, CAIA Ferguson Wellman Capital Management

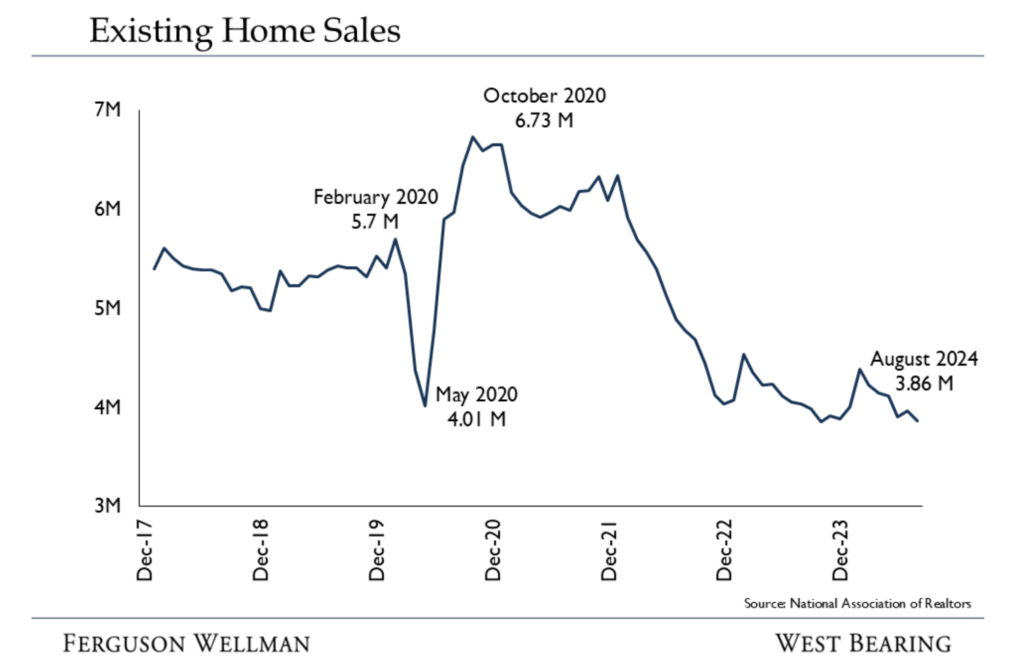

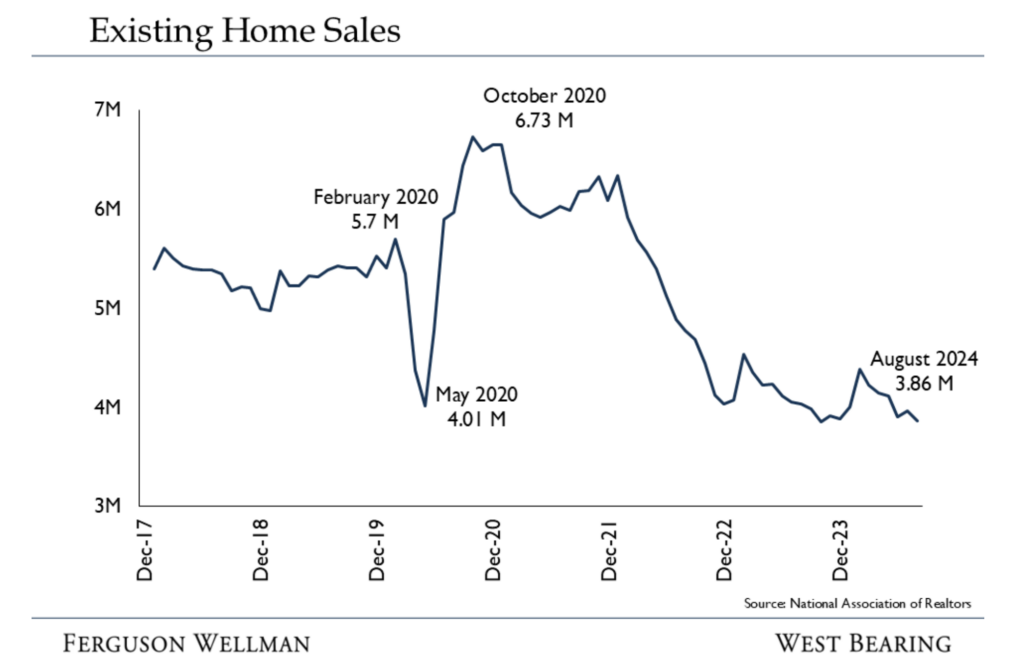

Recently, a realtor friend shared that transaction volume was low due to high interest rates, resulting in a sluggish market. However, with last month’s Federal Reserve’s rates cut, he and others in the realty industry are hoping for a reenergized housing market. Given that homes are usually a household’s largest asset, homeowners and realtors alike should be curious about the impact of rate cuts on housing prices.

The Fed’s 50-basis point rate cut has already impacted mortgage rates. The average 30-year fixed mortgage rate has dropped to 6.08%, its lowest level since September 2022. While higher than the sub-3% rates of 2020-2021, it’s a significant decrease from the 7.79% peak in October 2023.

This rate cut has immediately affected mortgage applications. According to the Mortgage Bankers Association, September saw a surge in applications compared to the previous month. Refinancing applications increased by 50.3%, while new home purchase applications rose by 12.4%.

My realtor friend should see greater success soon as U.S. housing prices should increase as a reaction to lower rates. We believe home prices are poised to appreciate further for two reasons.

The first reason is the persistent housing supply shortage we have been facing. A severe “drought” in housing supply exists, with new home starts having peaked in 2007. Since 2012, new household formations have significantly outpaced new single-family housing starts, resulting in a gap of approximately 7.2 million units by the end of 2023. This shortage has driven U.S. home prices up over 50% in the last five years, more than double the increase in wages.

Higher interest rates have exacerbated the supply problem by making it more expensive for homebuilders to finance new projects. Even as rates decline, housing supply remains inelastic in the short term due to project planning, zoning, permitting, and financing approval times.

The “lock-in effect” also contributes to the supply shortage, as homeowners with low mortgage rates are reluctant to sell and buy new homes at higher rates.

The second reason we anticipate appreciated home prices is due to increased demand for lower rates. Lower rates inherently increase demand by making mortgage payments more affordable. The Redfin Homebuyer Demand Index, which tracks home tours and other buying services, has reached its highest level since May 2024, showing a 7% increase from the previous month and a 1% annual increase.

Market Outlook

The fundamental law of supply and demand reigns supreme in the housing market. The current imbalance between supply and demand, coupled with the stimulative effect of lower interest rates, creates a favorable environment for housing price appreciation.

However, this trend will not be uniform across all regions or price segments. Factors such as local economic conditions, demographic shifts, and regulatory environments influence housing markets at a more granular level. For example, metros in Sun Belt states (Nevada, Arizona, Texas, Carolinas, Florida) have the highest job and population growth metrics, and consequently, should see greater home price appreciation. The same can be said for the mountain west region (Idaho, Utah, Colorado metros). And while coastal cities are seeing more modest population growth, the outer-suburb areas of these metros are experiencing better trends driven by lower cost of living and quality of life as hybrid jobs enable people to live further from employment centers.

For these reasons, housing remains a central investment theme in alternative assets and public equities. The recent rate cut should provide a boost to home prices nationally, although the impact may vary across different markets.

The post Home Sweet Home Economics: Decoding the Fed’s Impact on Housing appeared first on Bend Chamber of Commerce.

Recent Comments