by Alex Harding, CFA, Ferguson Wellman Capital Management

After last November’s election, it was widely expected that tariffs would become a significant focus in 2025. Initially, markets downplayed these concerns, viewing them primarily as negotiating tools rather than serious economic threats. Sentiment has shifted dramatically in recent months, with tariff concerns evolving from a minor issue to a genuine growth concern heavily impacting market performance with the S&P 500 index declining 20% in early April from its February 19th high.

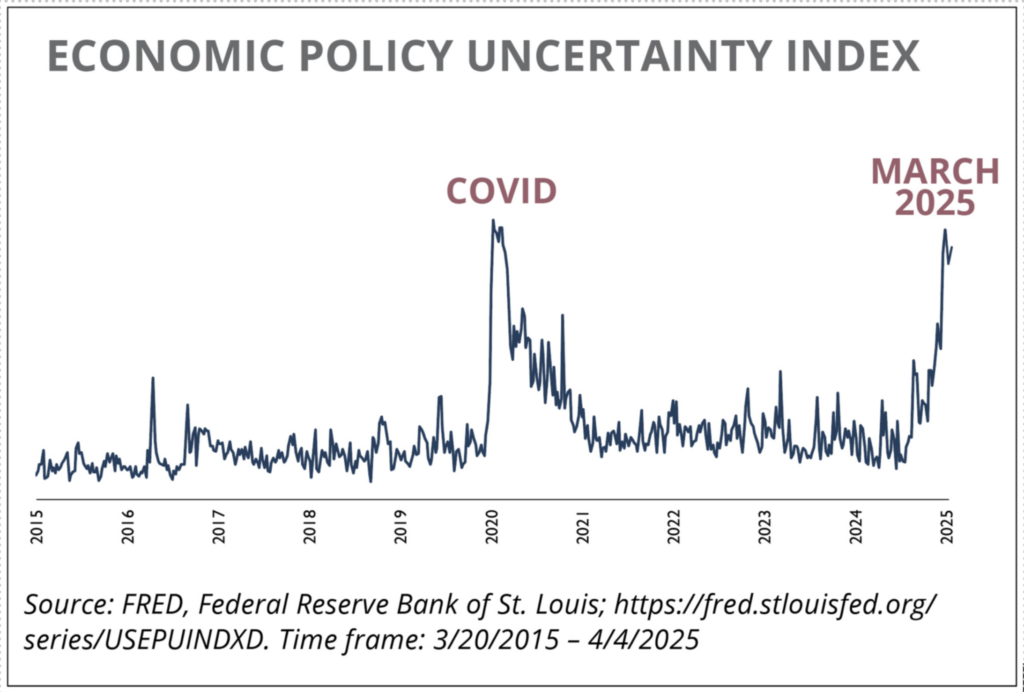

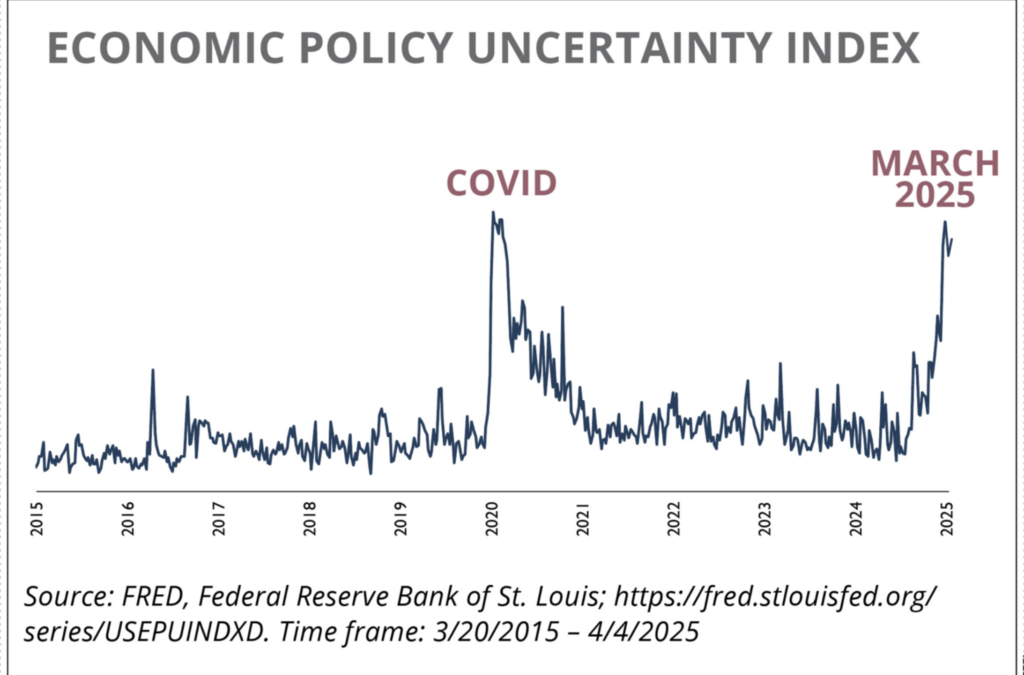

As of the time of this writing, the tariff policy, despite a 90-day pause on “reciprocal” tariffs for all countries except China, remains unpredictable and dynamic – we expect this to remain the case over the near term. In response, economic policy uncertainty has spiked and is back to levels not seen since the peak of the COVID-19 pandemic.

In its simplest form, a tariff is a tax imposed by a government on goods imported from a foreign country. A common misconception is that tariffs are paid by the foreign company exporting the goods. While the foreign exporter can be impacted through reduced demand or lower selling prices, the domestic company pays the import tax with some, or all, of the cost being passed onto the end consumer in the form of higher prices.

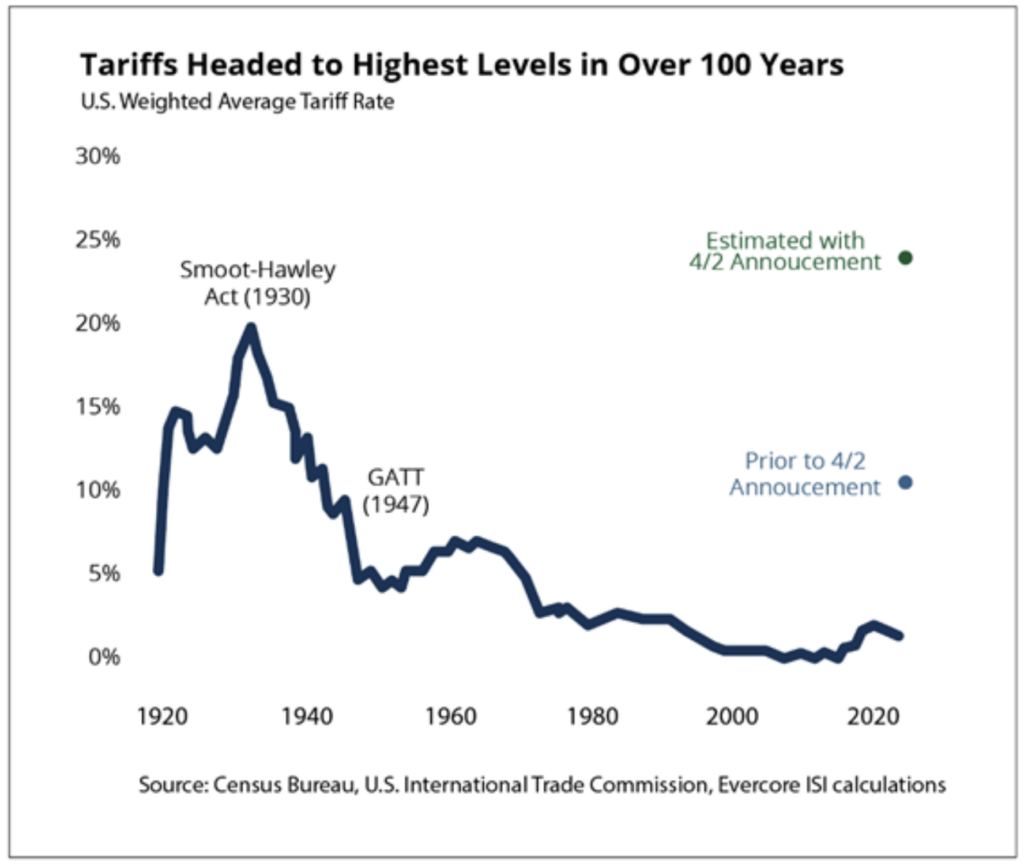

The use of tariffs has been used in practice for centuries – the United States implemented its first tariff in 1789 to protect its burgeoning manufacturing industry and to raise revenue for the federal government. Over the past century, the use of tariffs has become much less commonplace. Global trade agreements have reduced trade barriers, resulting in the weighted average U.S. tariff rate declining to 2.5% as of 2023.

If the Trump administration’s tariff policy is fully enacted as proposed on April 2nd, the effective U.S. tariff rate is estimated to be around 25%, exceeding the levels of the Smoot-Hawley Act put in place nearly 100 years ago (see chart below). To further frame the severity of the proposed tariffs, research firm Strategas estimates the tariffs would generate around $620 billion in annual revenue (assuming no change in behavior) – nearly a $100 billion more than the U.S. Treasury received from corporate taxes last year.

The formula for calculating “reciprocal” tariffs make it clear the Trump administration is targeting countries with large trade deficits and non-tariff barriers (e.g.,. quantity controls, export subsidies) rather than the actual tariff rate imposed on U.S. exports. Even before the 90-day pause on the more aggressive trade policies, negotiations were underway and the administration implied the levels of “reciprocal” tariffs could move lower if concessions are made. Retaliation from trading partners is another factor to watch that could lead the administration to further alter its course. Regardless of the final size and scope of tariffs enacted, the Trump administration is focused on reducing the U.S. trade deficit, reshoring manufacturing jobs back to the United States, and using tariff revenue to offset tax cuts for individuals and corporations.

The uncertainty surrounding the whole situation can have a chilling effect on economic activity and increases the odds of a recession. In this environment, businesses hit the pause button on investment decisions, and new hires as profitability and solvency become paramount. Consumers facing fear of higher prices are more likely to pull back on discretionary spending. It is anticipated that this fear will negatively impact demand for industries such as retail and tourism.

Despite the 90-day pause announced last week, the current set of universal, sectoral and country-specific tariffs will create challenges for Central Oregon industries. The housing sector looks particularly impacted with the National Association of Home Builders estimating 7% of new housing construction materials are sourced from foreign countries, and 85% of softwood lumber is sourced from Canada. Lumber tariffs from Canada are expected to increase from 14.5% to 34.5% later this year – only adding to the ongoing housing affordability and supply shortages in Bend. In addition, industries, such as manufacturing and retail stores, with products that rely on steel, aluminum or Chinese-made parts, will have to determine how much of the additional cost they can absorb before passing it along to the end consumer. Many more industries will face similar dilemmas. Our hope is that the 90-day pause allows concessions from both sides and clarity to improve throughout the summer as no one wins in a tit-for-tat trade war.

Recent Comments